In last week’s issue, Part I of Looking Back And Looking Forward, we looked at major tech breakthroughs that aren’t hitting the mainstream media.

Those were positive, feel-good developments that we heard little to nothing about.

While chatting with a 28-year-old successful teacher-turned-female-entrepreneur recently, I asked her if she’d seen anything about the nuclear fusion breakthrough.

One of the biggest breakthroughs to advance the human race, and she hadn’t heard about it.

It’s not her fault though. It barely made headlines anywhere.

Today, I want to share with you some predictions about the 2023 markets in the big 3:

Real estate, Stocks, and Crypto.

Before we do that, we need to have an idea of what the Fed is going to do with interest rates. In the short term, what happens with the Fed will move the markets.

Over the long term, productivity, growing earnings, and innovation will always prevail.

What’s The Fed Going To Do?

The Fed has been hiking rates higher and faster than at any other time in recent history. This caused all asset classes to focus on what the Fed said and did. It’s what made things like Bitcoin and the S&P 500 so correlated.

The positive bit here is that rate hikes are slowing.

More importantly, the hike is getting closer to its terminal rate. It’ll soon stop hiking.

Right now, the CME Group’s FedWatch Tool is forecasting this terminal rate to be reached in either February or March 2023. The rate is expected to be between 4.75% and 5%.

This is a good sign, as rate hikes in 2023 will be less of a talking point than what we saw in 2022. However, forecasts are that in the later half of 2023, rates will start to fall.

The key point is that whether the Fed stops hiking rates or cuts rates, this will be favorable for both the equity and digital asset markets. I would argue for digital assets, in particular.

It’s extremely vital to note here that ultimately, the Fed will not solve the inflation problem.

Technology will.

Think of it this way. What were flat-screen TVs going for a couple of decades ago? $10,000? Plasma TVs were going for $30,000 when they first came out.

And now, every low-income rental house that I’ve been in or seen pictures of has a flat-screen TV that they purchased for what, a couple of hundred bucks?

As technology continues to advance, it is becoming increasingly apparent that consumers are benefiting from the dropping costs and prices of products. This can be attributed to the fact that technological advances have enabled companies to produce more goods at a faster rate, resulting in lower production costs.

Additionally, as technology improves, businesses are able to become more efficient when it comes to their operations by automating processes and utilizing new tools. All these factors result in lower prices for consumers which leads to increased consumer satisfaction and greater economic growth.

Where’s The Real Estate Market Headed?

The aggressive interest rate hikes have been terrible for real estate sellers. The Fed has raised rates by more than 14 times the starting basis point. That’s insane. Sellers getting multiple offers over the asking price is mostly a thing of the past, save for select markets and select pockets within those markets.

It also shows the strength of the market.

You would think that crazy hikes like this would crash the market. But there is a severe shortage of housing that dates back to the 2008 crisis. New builds almost froze for several years, and that created a supply shock that we still have today.

Today is the best of all times to be an investor. When they say that it’s a “seller’s market”, obviously the advantage goes to anyone selling their home. In 2021, I put my rental home on the market in Arizona, a simple 3-bed C-class property, and within 3 days, I had 12 offers over the asking price. It eventually got bid up from the $210k asking price to $230k. There was absolutely nothing special about this property and no rational reason for it to sell for $230k. But that’s the magic: High demand.

And now, we are in a “buyer’s market”.

I’ve owned a real estate investment company since 2016, and until 2020, everything was going very well. We could find lots of deals, especially distressed properties that needed construction work to bring them to rental standards. My partner and I did well with what’s called a “forced equity” strategy. That means when we bought the property, we forced the value up quickly by making improvements. We didn’t have to wait around for natural market appreciation. We forced it up ourselves.

But in 2020, that all changed. The massive Fed money printing caused real estate prices to go through the roof. And although that was great for any properties we held, it was terrible for any new acquisitions. We closed very few deals and mainly focused on selling our holdings to take advantage of the bubble.

Now we are on a buying spree.

If you’ve been sitting on the sidelines, it’s time to get in the game.

Where Are Stocks Headed?

As I mentioned last week, the US bond returns versus US stock returns is also a useful way to show us what this year has been like compared to others.

To oversimplify, years are “good” when both bond and stock performance are positive. And years, where bonds moved lower than stocks, are “very bad”. So far, there have only been three “very bad” years: 1931, 1969… and 2022.

We might even argue that 1969 wasn’t that bad at all considering the drawdowns were in the single digits for both stocks and bonds.

1931 speaks for itself, as it was the time of the Great Depression. The banking sector collapsed, as did the stock market. Unemployment skyrocketed and the Federal Reserve began hiking interest rates to stabilize the U.S. dollar.

Obviously, those were very different times back then. Plus, the stock market crash affected a very limited number of people, as only about 16% of the population had any exposure to the stock market at that time. Clearly, that’s not the case in 2022. Today, that number is around 58% in the U.S. In fact, talking about households earning $100,000 or more, the percentage jumps to 89%.

Making matters worse, the national debt has almost reached $31.5 trillion now. We have a debt-to-GDP ratio of almost 122%. I still find it hard to fathom how much damage has been done in such a short period of time.

I mention this as a backdrop for 2023. I understand that this might sound dire, but that’s not the impression that I intend to give. I’m actually far more optimistic about 2023, particularly the second half of the year for reasons I’ll explain.

Historically, the S&P 500 has always moved higher in the one-year period following every midterm election over the last eighty years. It’s a perfect record.

But our new reality will be quite different. Due to the money printing of the last two years and the record levels of debt to GDP, we’ve crossed the Rubicon. “They” never intend to pay the debt back; and we should assume that record-level deficits will continue to be run for at least the next two years, making the debt burden even worse.

Our new reality needs to assume higher rates of inflation for extended periods of time. We can forget about the 2% target that the Federal Reserve used to talk about all the time. I don’t believe it will be long before it will be a “4% inflation target.”

The real reason that growth underperforms is because institutional capital flows out of small-cap growth stocks as it looks for safety. When there are far more sellers than buyers, asset prices naturally drop – to irrational levels even.

There has been too much fear in the market this year and too much economic, geopolitical, and monetary policy uncertainty to give institutional capital the confidence to return back to growth equities.

Don’t worry, that won’t last. Inflation is clearly slowing. The latest reading of the topline CPI—the government’s official record of inflation—came in at 7.1% year-over-year. This was lower than the estimated 7.3%. The Fed’s historically aggressive rate hikes are causing severe pain in the equity markets and consumer markets. Consumer demand is falling.

The housing market has rolled over and even lumber prices have returned to pre-pandemic levels. We’re not far from the Fed pausing its rate hikes, which I believe is most likely by the March 2023 FOMC meeting.

The Fed will continue to raise until the housing market breaks and the same happens in the debt markets. This will give the U.S. government cover to implement new forms of quantitative easing and stimulus. I’m even predicting that rates will start to decline in the second half of 2023.

But what’s coming in growth stocks is unlike anything I’ve ever seen. The reality is that despite the terrible conditions that we saw in 2022, venture capital and private equity investment into technology and biotechnology powered ahead. And public tech and biotech companies powered ahead with their research and development. And this was after three record years in a row of industry investing in future growth.

Next year is going to bring a number of unbelievable breakthroughs in artificial intelligence, augmented reality, quantum computing, nuclear fusion, robotics, autonomous driving, blockchain technology, genetic editing, software, automation, semiconductors, biotechnology, and life sciences.

The breakthroughs this year in protein science and understanding both protein structure and protein folding were a once-in-a-century advancement. And the whole industry has access to technology that was entirely enabled by artificial intelligence. Next year is when we’ll see this newfound knowledge put to work for therapeutic development.

Bottom line: I think that stocks will have a nice turnaround toward the second half of this year.

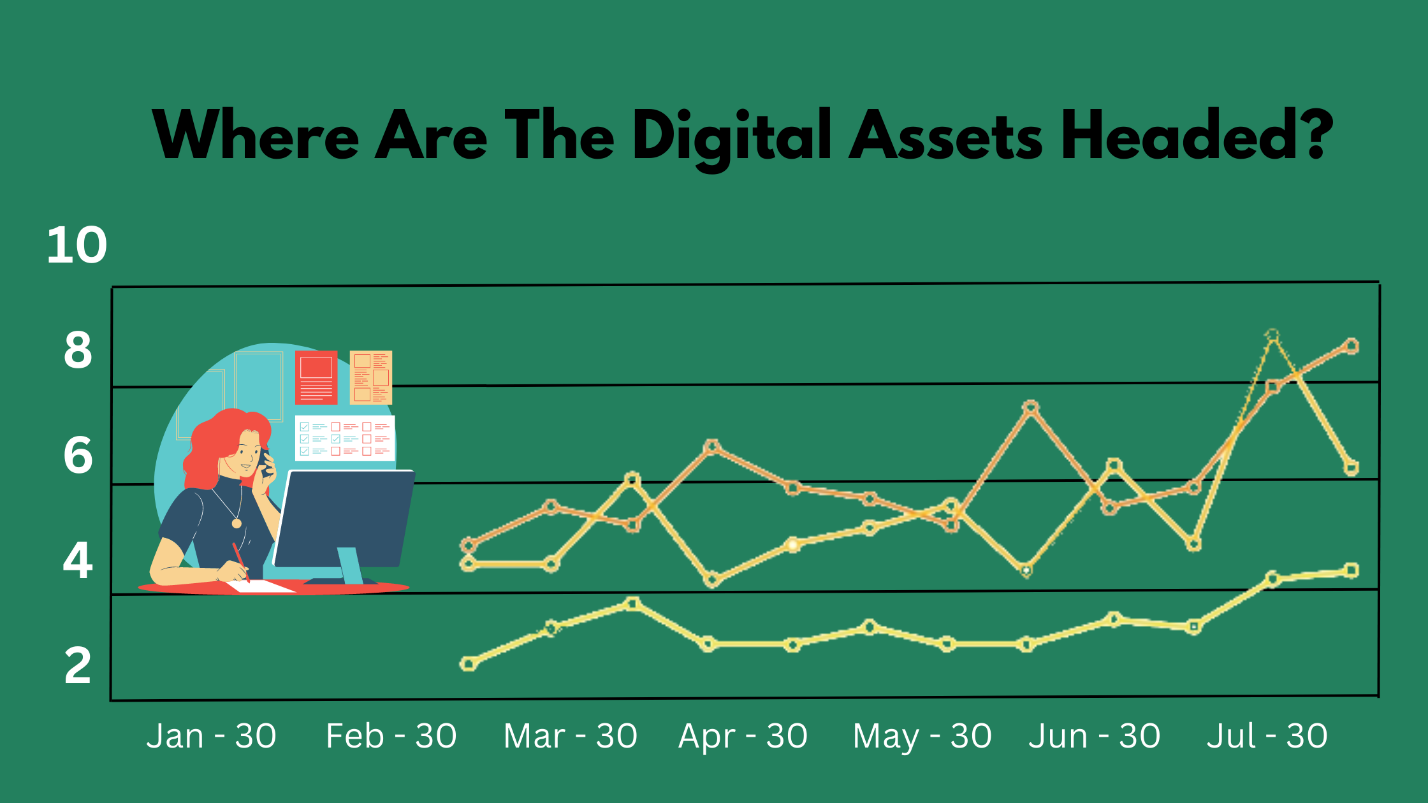

Where Are The Digital Assets Headed?

This year saw the near-collapse of several centralized entities operating in the space.

The irony of what happened isn’t lost on me. After all, blockchain technology is, by design, supposed to be decentralized and trustless (i.e., we don’t need to rely on trust in some centralized party for any transaction).

The trouble began in spring. A project known as Terra Luna collapsed in May. Terra Luna experienced a “bank run.”

The fall of Luna would have ripple effects. By June, a multibillion-dollar fund called Three Arrows Capital became insolvent. The fund was highly leveraged and badly exposed to Luna, and other assets got caught up in the volatility.

The ripples from these blow-ups continued to spread into the second half of this year. Three Arrows had created its leveraged trades by borrowing capital from entities like BlockFi and Gemini, among others.

Fear began to spread that these companies would also fall. And it was at this time that a supposed “savior” appeared.

Sam Bankman-Fried (SBF) – CEO of the centralized exchange FTX – agreed to extend a $250 million line of credit to BlockFi. He also agreed to bail out Voyager, another company on the brink of collapse.

SBF was lauded for his actions. He was considered by some to be the “JP Morgan of cryptocurrencies.” And for a moment, it looked like stability had returned to the digital asset markets. But it wouldn’t last long.

As we all now know, FTX and its quantitative research arm, Alameda, was a house of cards. The level of mismanagement and corruption is hard to imagine.

Through a combination of incompetence and outright fraud, FTX and Alameda have both collapsed. FTX declared bankruptcy last month, unsurprisingly followed by BlockFi.

But FTX didn’t collapse because the Bitcoin blockchain failed to validate a transaction. Three Arrows didn’t implode because the Ethereum network failed to execute a smart contract.

Throughout all the turmoil, decentralized applications continued to operate flawlessly.

The collapse of these various centralized entities happened for the same reason they’ve always happened: irresponsible leverage, too much risk centralized on too few entities, human incompetence, and (I would argue in the case of FTX) outright fraud.

There’s no denying that these events, combined with the overall market weakness, have led to a very tough year for digital assets.

But there are reasons to be optimistic looking forward.

For starters, I believe this has been a wake-up call for the industry. For another, I’m hopeful that these events will finally give the industry the consistent and fair regulatory guidelines that the industry has been asking for over the past several years.

And if we look at the historical dynamics of the market itself, there are reasons to expect far better conditions next year.

For almost 14 years, the digital asset market ebbed and flowed around a single asset, Bitcoin.

Bitcoin represented almost 100% of the total digital asset market in 2013. Today, that figure has come down to about 40%. It still encompasses a large portion of the market.

As Bitcoin goes, so goes the market. And in turn, the most important catalyst surrounding Bitcoin was regular “halvings.” These halvings refer to how many new Bitcoins are created per block.

It takes approximately four years per “halving” – the rate at which newly minted tokens are created.

We can think of this as a change in supply. And it’s this supply change that results in new cycles for Bitcoin. That’s because as new demand enters the market, it’s met with fewer new coins being created.

For a new network like Bitcoin, that can result in supply shocks that lead to outsized price movements to the upside.

Bitcoin has experienced three halving events in its lifetime. If we were to plot its price relative to these halving events, we can see its cycles more clearly.

Today, we’re approximately 950 days into this cycle. This is important for us to consider.

Looking Toward The Next Halving

Bitcoin tends to be the barometer of digital assets. If it rises, the rest of the market rises along with it. If it falls, prices tend to follow across individual assets.

And if this cycle is similar to previous cycles, then we have a lot to look forward to for 2023!

The halving events in 2012 and 2016 led to a surge in the price of Bitcoin. Both times, this rally lost steam after approximately 900 days. But after bottoming, the asset continued higher.

We’re at that 900-day mark now from the latest halving. And similar to the previous two cycles, the asset has come down. Recent events surrounding FTX have put downward pressure on Bitcoin and all assets.

But if the previous two cycles hold here, we should see renewed strength for it in 2023. We should also consider that the policy of the U.S. Federal Reserve will become less restrictive next year. That will create a boost to both the equity and digital asset markets.

The timing of this is extremely favorable for digital assets in 2023. The combination of Bitcoin’s halving cycle in addition to easing monetary policy could pave the way for the start of a major bull run.

The downtrend that we experienced this year is just part of the typical volatility that we often see in an emerging asset class. As the industry matures, we’ll see less volatility and more tangible adoption and growth.

In short, the future is bright for blockchain technology.

Whenever you’re ready, there are 5 ways I can help you:

1. Learn the strategies to create multiple streams of passive income with my new book, Building Indestructible Wealth, here.

2. Build the foundation of your plan with my online learning course, The Indestructible Wealth Builder here.

3. Develop and implement specific strategies in real estate, stocks, and crypto to generate income. Learn how to buy early-stage assets that can 10x in value with my Advanced Indestructible Wealth Builder online learning course here.

4. Invest along with me. Join my private Premiere Mastermind group to get real-time alerts on pre-IPOs, stocks, real estate, and crypto.

5. Work 1:1 with me to get focused, intense guidance to turbocharge your results.