You don’t need to quit your job to get into real estate. Why not start passive real estate investing? Read on to learn how I did it and how you can too.

Over the past decade, I’ve used real estate to generate over $2 million in “side hustle” income that powers my wealth building strategies, diversifies my income streams, and protects my family from the volatile public financial markets.

Heck, I used the rental income from my properties to buy my first Tesla, which means I enjoy the car without the stress.

Not a millionaire yet? You are in the right place.

Already a millionaire? You are also in the right place (My Real Estate Side Hustle Strategy #3 is absolutely perfect for you).

Table of Contents

How Can You Make More Money?

Often, people will ask me for tips to get started with a few thousand dollars, sometimes a fifty and sometimes a hundred or more.

My team and I use over 10 different processes for creating successful real estate profits, including fix and flips, wholesaling, and even selling furniture to investors for short or medium term rentals (think corporate relocations for six months).

Several of these are active businesses, and I’m going to assume here that you want to stay focused on growing your primary income stream, which I typically recommend, and invest in real estate more passively.

When I look back at the different ways I’ve profited in real estate, the biggest profits with the least amount of work have been from passively buying and holding property.

The result of endless government money printing is inflation, and our government has printed trillions of dollars to stimulate our economy. Inflation drives up the prices of real estate.

With inflation currently sitting at 8% and not showing a lot of signs of slowing down, you will not go wrong owning property in a highly inflationary economy.

Today I’m going to share 3 less-known ways that you can build a passive real estate investing portfolio quickly and easily, with no experience and without lifting a hammer (believe me, this pretty boy has NOT), with anywhere from $50 to $100,000.

And best of all, they are passive, or mostly passive, so you can stay focused on what you do best: Providing more value and growing your career or business.

How To Make Money With Passive Real Estate Investing: My Top 3 Strategies

Passive Real Estate Investing Strategy #1: Crowdfunding Real Estate

- Risk Level: Low to Medium

- Type of Investor: Beginner

- Minimum Starting Capital: $50

- Potential Returns: 8%-12%

I love crowdfunding real estate because it allows young, inexperienced investors to quickly and easily get exposure to the real estate asset class, with very little capital. Surprisingly, on platforms such as Fundrise, you can access their flagship fund for as little as $50! Now, you and I are both clear that investing in real estate with $50 increments, or any asset class for that matter, will not move the needle on your net worth a whole lot. However, it gets you started.

Let me take you back to the one thing I remember from my 7th grade Science class, which has stuck with me as it applies to life in a big way: “A body in motion tends to stay in motion. A body at rest tends to stay at rest.”

That’s the Law of Inertia, which is why it’s so hard for you to get to the gym, but why once you’re there and moving, it’s so much easier. Getting started is always the hardest part. I say this now because I know most of you are simply procrastinating on getting started with real estate for years but haven’t yet. This is your sign to get the ball rolling with very little time commitment.

Crowdfunding is the practice of funding a project or venture by raising money from a large number of people, typically via the Internet. While profitable, historically, the real estate investing industry requires larger amounts of capital. Fundrise investors are able to own real property in a more low-cost way than was previously ever possible.

P.S. I don’t have a sponsorship deal or any financial incentive to recommend Fundrise, I just think it’s a great platform.

Why It Works

Crowdfunding platforms handle virtually every piece of the real estate business in-house. They work directly with real estate developers and operators, handle the financials, and manage the deals. Because they’ve eliminated most intermediaries, they’re able to keep their expenses low.

Within minutes, you can create an account, choose your portfolio strategy, and watch as your dollars are diversified across a series of investment funds tailored to your selected strategy.

After you place your initial investment, they’ll keep working to find and add new assets to your portfolio over time — with no additional investment required on your end. This means your already-diversified portfolio can become stronger year after year.

Through your in-app newsfeed, you can watch each asset in your portfolio evolve over time. The platform will regularly publish new asset updates, including milestones like new construction progress, occupancy reports, market data trends, and project completion alerts.

They do all the work. You just focus on earning.

When you invest in crowdfunding platforms, and all real estate in general, remember this is not a liquid asset class. This means that you cannot pull your money back out quickly. With stocks, you can cash out with a click on business days between 9:00 am – 4:30 pm Eastern. With crypto, you can cash out 24×7.

With real estate, especially in funds, your cash is often locked up for 3 to 5 years. This lack of liquidity is what I like about it. It provides more stability and steady growth and isn’t at the mercy of public sentiment.

ACTION TO TAKE: To get started with Fundrise, go to www.fundrise.com and set up your own free account based on your starting capital. Fund your account, and sit back and do nothing.

Passive Real Estate Investing Strategy #2: Turnkey Real Estate

- Risk Level: Medium

- Type of Investor: Any

- Minimum Starting Capital: $30,000

- Potential Returns: 7%-20%, depending if long term or short term rental

Turnkey companies buy off-market or distressed properties, fix them up, and then sell to investors like you as a cash flowing property.

This model is called “turnkey” because you are buying once the property renovation is complete, and a tenant is placed. You’re buying a cash flow producing property from day 1, without personally getting involved in any of these processes.

Buying a turnkey property allows you to fully control the property, and use leverage (get a bank loan) so you can control more properties. There is no reason to buy 1 property with all cash when you can buy 4 with the same money, unless you’re not comfortable with any debt.

Back in 2014, my stocks dropped like a rock. There was some market manipulation going on, along with a lack of diversification on my part. I vowed to myself that I would learn and invest into real estate.

I ended up buying turnkey, because after quite a bit of research and looking at deals, I realized 3 things:

- I was getting distracted from my primary business, which was clearly becoming costly to the growth of my main asset.

- There was so much I didn’t know, and plenty that I didn’t know that I didn’t know. As Jim Rohn says, “What you don’t know will cost you.”

- I couldn’t find any deals that made sense in my local area. When I heard, “Live where you want to live, but invest where it makes sense,” I had a massive mindset shift, and started looking at other more profitable rental markets across the country.

I soon realized that was the right thing to do. I started buying up turnkey properties in Indianapolis, ranked consistently in the top 5 cash flow markets in the US. In my first year, I had already generated $75,000 in rental income.

But my turnkey provider turned out to be shady, so I started my own company in 2016. We’ve sold over 300 properties to investors, and although we don’t do turnkey anymore, we’ve developed a great network of partners in multiple markets that help investors find quality turnkey properties with great management teams in markets such as Birmingham, Memphis, St. Louis, and Chattanooga.

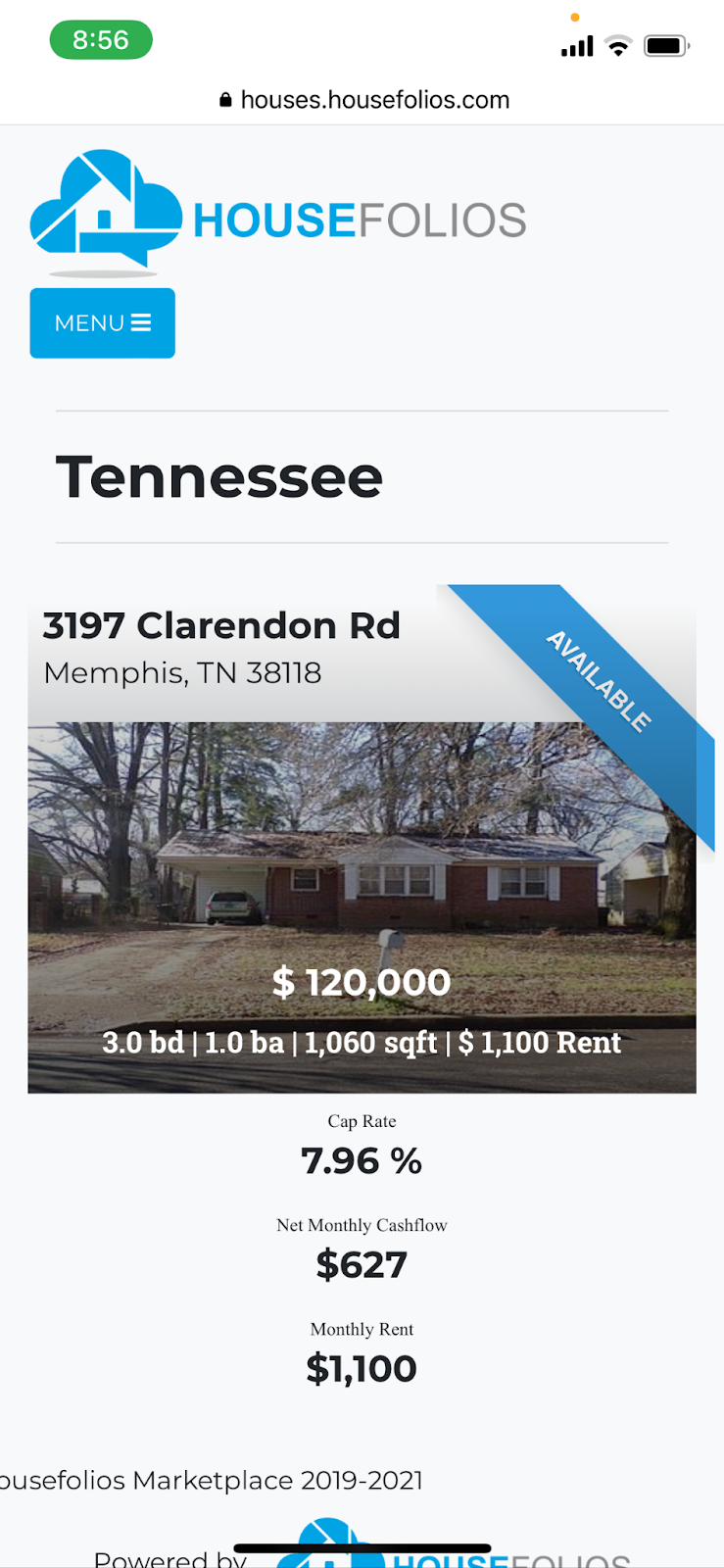

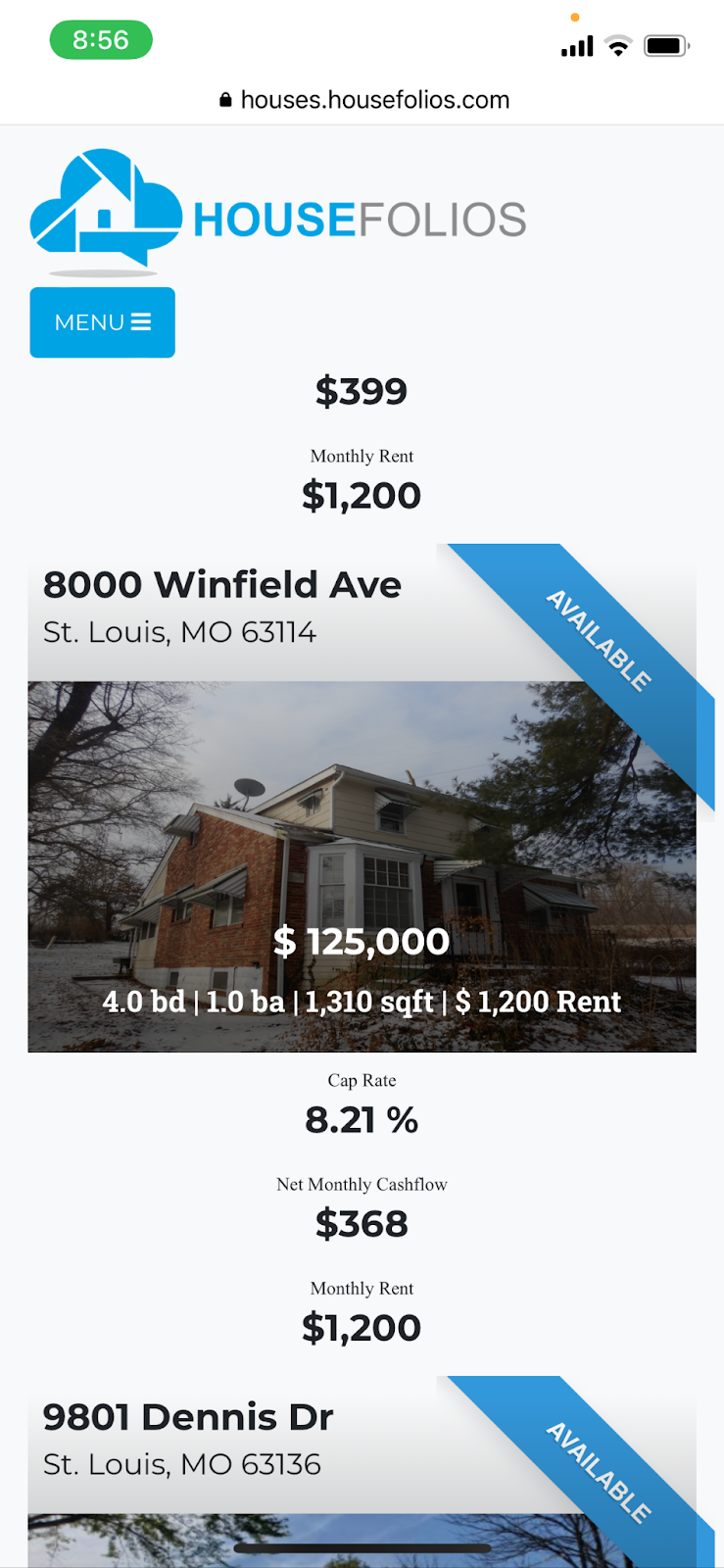

Here’s an example of 2 available properties as of the time of this writing. They’ve been rehabbed and a tenant has been placed. As you can see from the exterior photo, these are nice properties you can be proud to own. They aren’t likely to be home runs, but what you want to focus on is a collection of single base hits.

The Cleveland Guardians, my MLB team, beat the New York Yankees in game 3 of the Divisional Playoffs, a team that spends $200M more per year on payroll, that’s loaded with home run sluggers.

Down two runs headed into the bottom of the ninth, according to statistics they had a 4% chance to win. Yet, they pulled off an incredible comeback with a collection of back to back singles. They just kept getting on base, consistently and relentlessly.

Ready for a turnkey property? Book a call with Nicole, the head of Investor Relations for High Return Real Estate. She owns 10 properties as a stay-at-home mom, and can help you get started. Email her directly: [email protected].

Passive Real Estate Investing Strategy #3: Syndication

- Risk Level: Medium

- Type of Investor: Experienced & Accredited*

- Minimum Starting Capital: $50,000 – $100,000

- Potential Returns: High, 15%-30%

Syndication is my route to profitable real estate investing if you have large amounts of capital to deploy. They’ll get you high returns and gift you the luxury of leaving it to be completely passive.

Rental property, though an amazing wealth-building asset, is not completely passive. I call it semi-passive, because even with a property manager, you’re still running a business with income, expenses, customers (tenants) and a team (property manager).

But Syndication is a lot like crowdfunding. The only difference is that it’s a small group of investors each putting in a lot of capital. *In most cases, to qualify for syndication deals, you need to be what the regulatory bodies call an Accredited Investor.

You need to hit $200k annually as a single filer or $300k filing jointly with your spouse, or have a million-dollar net worth outside your primary residence.

Essentially, the regulatory bodies are saying that at this stage, you will have a greater ability to make wise decisions on private placement deals – investments that are off the market and not regulated like publicly traded stocks.

I started investing in syndicated self-storage facilities after meeting Shawn on a vacation to Cabo back in 2010. He was running a private equity fund where he was buying up large self-storage facilities, fixing them up, improving the rental performance, and then ultimately selling them to a large pension or hedge fund in a monster exit.

Here comes the most powerful part:

Shawn and his team have done 120 deals and not one time have they lost. Their lowest performing fund was 10% and that was a very short-term deal. On average, they’ve hit 25% annualized returns across 120 deals over a decade.

That’s CRAZY.

The secret to their success is largely based on their acquisition teams. They’ll look at 100 deals to get one that qualifies.

With this, they can move quickly and close with cash, which causes distressed sellers to take their lower priced offers over higher offers that may take a while to close. At a whopping 25% annualized returns, your money is doubling every 4 years.

I don’t know about you, but why on earth would someone invest into much riskier mutual funds, which have all dropped at least 25%, if you have access and accredited status to invest into an asset that will always have real value no matter what the economy does?

In fact, it’s not even just about performance. My business coaches, Jan and Monika Zands, paid $250 a month for 15 straight years on their storage locker before they cleared it out and ended their lease.

These are smart, savvy people willing to pay for 15 straight years without missing a beat. Why? Because they don’t have to deal with any headaches. There are no tenants, toilets, or trash to deal with because people aren’t living in your units, their stuff is.

The self-storage fund that I invest in is currently raising capital. It opens once or twice a year for 3-4 weeks and then it closes, so you do need to move quickly if you want to get involved.

ACTION TO TAKE: If you’re Accredited, email me at [email protected] and I’ll send you some more information.

Sneak Peak: Building teams is my secret sauce to level up my income. We dive into the keys to building teams so you can enjoy your life and reduce your time “in” your business and work more “on” it. Read the full blog here.

Whenever you’re ready, there are 3 ways I can help you level up your finances:

- Take an affordable self-learning e-course: COMING SOON

- Take our new interactive course The Indestructible Wealth Academy to help you buy ten cash flowing properties within two years, with the goal to create a million in equity: COMING SOON

- Ready to invest your money?

→ Buy cash flowing, turnkey real estate. It’s acquired, renovated, and managed for you by my company, High Return Real Estate.

→ Wish you had bought bitcoin back at $12,000? Now you can with my company Simple Crypto Mine. We provide the machines, the hosting, the technical expertise, and the maintenance. Watch bitcoin drop in your wallet every five days for another stream of passive income. Email me at [email protected] to request the investor packet.

→ Are you an Accredited Investor with larger amounts of capital to invest? Syndicated deals in self-storage and car washes are 100% passive and very lucrative. Email me at [email protected] to request the latest investor replay to learn more!