Retirement planning can be a daunting task, especially when relying solely on traditional income streams. As an entrepreneur and investor who has experienced the ups and downs of financial instability, I understand the fear that comes with not knowing how to ensure a comfortable retirement.

That’s why I decided to think outside the box and explore alternative retirement income strategies. After all, relying on a single source of income can be a risky proposition. I know this firsthand, as I’ve had to navigate financial setbacks and learn to adapt in order to build a more secure future.

Waiting for 40 years to retire is a bad plan. If you want to know about a good one, please read on.

Table of Contents

Thinking Outside the Box: My Alternative Retirement Income Strategies

You see, we are programmed from an early age to think of investing in terms of retirement planning.

The entire philosophy is to continually invest into the stock market for growth in your portfolio, and after 40 years of delayed gratification, you’ll arrive in this magnificent oasis of your golden years with abundant financial resources to live how you want.

And once you get closer to retirement, you want to adjust your portfolio to generate more income instead of growth, with an emphasis on more safety as you have less time to make up for losses in your portfolio.

I believe you should do the opposite. Let’s take a look at my alternative retirement strategies.

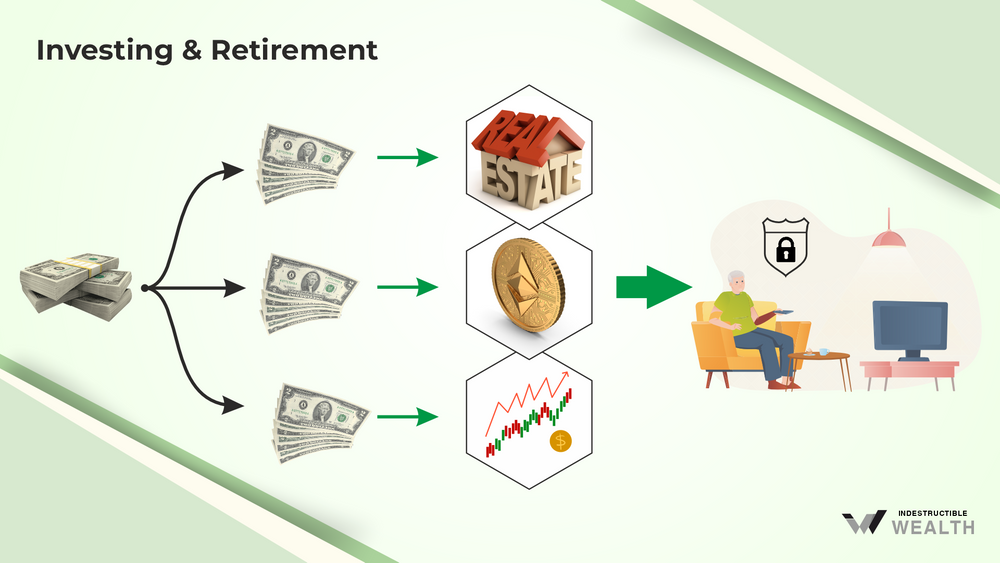

Strategy #1. Build multiple streams of income from safe assets

From what I’ve seen, most younger investors either gamble too much with their initial investment funds, or they simply cannot see the benefit of delaying gratification for forty years with the traditional approach.

They soon sabotage themselves by either losing their hard earned money in speculative, gamble-like deals, or they just do nothing. I can’t tell you how many young guys I know put too much money into crypto, or bought digital eCommerce stores with their first 50k.

Digital assets are still early, and any early stage asset is going to be highly volatile and extremely risky.

By focusing on multiple streams of income from the start, you can build your future on a firm foundation of safe, secure assets that consistently kick off cash flow, and give yourself the gift that keeps on giving: Income Consistency.

Young entrepreneurs will consistently have to deal with income inconsistency. Their business will cycle, and their job will always be at a risk from downsizing, corporate restructuring, office politics – you name it. If it can be disrupted, typically at some point, it will be too.

After going for massive growth in my portfolio as a 22-year-old senior in college with $50,000 in hard earned cash saved up, I learned my lesson the hard way. I invested into 100% tech stocks in March of 2000, and by September I was down $25,000.

I panic-sold like many did, trying to figure out how I could possibly lose so much in such a short period of time that took me three years of grinding effort and delayed gratification to accumulate.

“You know how many great fucking parties I could have thrown with that money?”, I constantly asked myself. Would have been a lot more fun and memorable than losing to other sharks in the market.

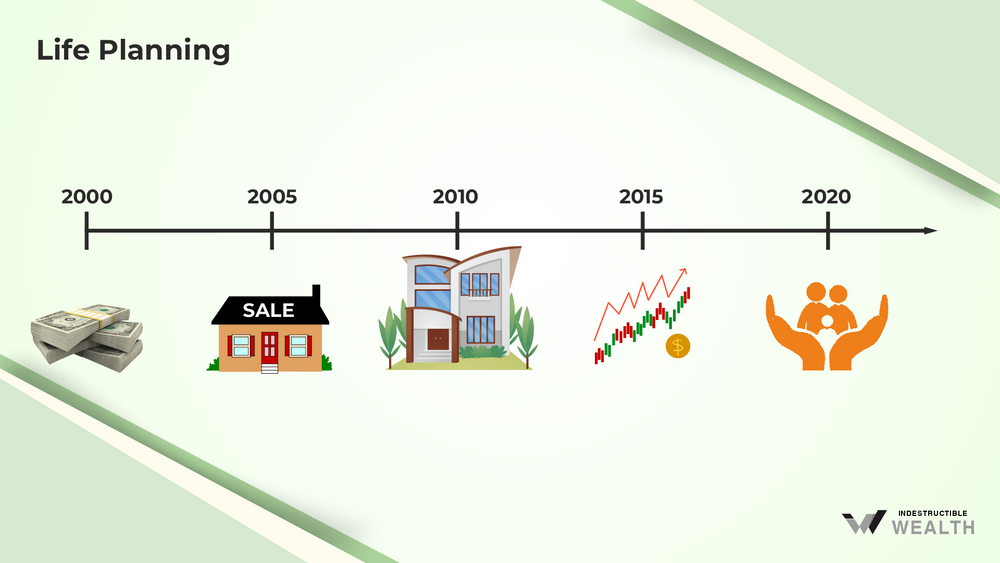

That dark period forced me to look at a different strategy. I then stayed away from stocks for many years. In fact, the next time I bought any stocks was in the post 2008 crash. Here was what my strategy looked like:

- From 2000-2008, I invested most of my cash flow back into myself and my business.

- Then, I focused on buying cash flowing real estate.

- I started with single family homes, and then worked my way into bigger deals like self-storage private funds.

- I did a lot of stock options to generate safer, consistent income from the market.

- I set up a high cash value whole life insurance policy that consistently cranks out dividends and interest.

Strategy #2. Use income from the safe streams to buy riskier assets

Once I had a portfolio of multiple streams, I took that income and speculated with it. Today, I use that income to buy up assets that are riskier, but have a reasonable chance of going up 10x or more in the next decade. My riskier bets are cryptocurrency alt coins, tech growth stocks, and private placements.

If these don’t work out, then the income from my portfolio of safe assets will replenish the income, and my lifestyle isn’t affected. I can swing for the fences again. Or, I can use it to shield against disruptions to my primary income.

As I said before, this is an inevitability of early income generation. There is nothing I can do about the fact that consumers are getting pummelled by high gas, housing, and food prices that are sucking dry their discretionary income.

With consumers having less disposable income, they aren’t buying as much of our health and nutrition products from my primary business, the one I started in college from the dorms. So naturally, we are seeing an income dip from that business.

But what if that were my only source of income? I don’t mean to sound doomsday, because this business is not going anywhere and I’m sure it will climb back, but in the meantime, that could be a significant disruption in our normal cash flows. We may have had to scale back some of our luxury expenditures like renting a lake house next weekend.

Fortunately, money rarely if ever weighs in on our decision. If we want to do it, we don’t ever have to have the sit down budget conversation. There really is no budget when avalanches of cash flow come in from so many different sources.

FAQs: Retirement income strategies

What is a realistic retirement income?

A realistic retirement income depends on several factors, including lifestyle preferences and the amount saved for retirement. The ideal retirement income should cover essential expenses such as housing costs, food and medical bills with room left over for leisure activities or travel. A combination of Social Security benefits, pension plans or annuities, personal savings from investments such as stocks or bonds, withdrawals from retirement accounts like 401(k)s and IRAs can all contribute to a realistic retirement income. Though each person’s needs are different when it comes to income levels in retirement since they require different levels of resources to meet their desired lifestyle choice. It’s important plan ahead financially so that you have a comfortable and secure life in your golden years.

What is a good monthly income for retirement?

A good monthly income for retirement depends on several factors, including your lifestyle, expenses and goals. Generally speaking, a comfortable retirement income would be at least 80% of your pre-retirement salary or wages. This means that if you were making an average of $50,000 per year before retiring, you should aim to receive at least $40,000 in retirement income per year. In order to achieve this goal it is important to limit living costs and save as much as possible during the years preceding retirement.

What are the signs that you should retire?

Retirement can be both exciting and intimidating, and there are some tell-tale signs that you should consider retiring sooner rather than later. First, if you find yourself struggling to keep up with the same job duties you’ve been doing for years without any feeling of satisfaction or enjoyment, it may be time to move on. Additionally, if your finances are in order and your health is good, those are great indicators that retirement should be a serious consideration. Lastly, personal fulfillment is key – when the things that once gave you pleasure have become mundane or tiresome, retiring may be a good move for finding new purpose and joy in life. Ultimately it’s important to listen to your instincts — if something inside tells you it’s time to go into retirement mode then take that as a sign!

What not to do in retirement?

When it comes to retirement, there are certain things that should be avoided in order to make the most of your golden years. First and foremost, retirees should avoid running up unnecessary debts and taking out large loans. Not only would this limit your financial security during retirement, but it could also cause an undue strain on your budget as you try to keep up with payments. Additionally, retirees should also be wary about making any long-term commitments or investments that may not pay off until well into their retirement period. Finally, retirees should avoid becoming complacent with their savings plans; even though you may already have enough saved for a comfortable lifestyle or healthcare needs throughout your retirement, staying vigilant when it comes to planning and saving is key for maintaining financial stability over time.

Finding the best assets for passive income

The question you’re probably asking is, “Yeah, all this sounds great, but I have no idea what safe, passive cash flow assets are available or what to invest in.” I get this question all the time on LinkedIn, as you can see this is pretty typical for one of my posts.

This is why I created two additional resources for you:

First, my free guide, “12 Investments for Dependable Passive Income..” This is going to tell you WHAT to invest in. This report took me hundreds of hours and study to vet and determine that, indeed these would protect your wealth and kick off multiple streams of income for you.

I believe just based on this guide, you could go out on your own and figure out how to invest into them. I wish I had a resource like this when I first started investing. I want to continually add value to you in the hopes that eventually you’ll value my content so much, you’ll share it with your social channels and give me some five star reviews.

Second, if you want to take a deeper dive and implement any of these 12 ideas, then my online video course will give you the HOW to buy them, and any other important considerations.

For example, in my guide is a description of convertible bonds, which may sound ultra conservative and something more suited for your 85-year-old sweet Grandma to invest in because she needs fixed income.

But when you pull back the curtain, you’ll learn that you can create safe, guaranteed income, AND have the chance to see 10x capital growth.

In the course, “The Indestructible Wealth Builder”, I give you three that you can invest in now. They are immediately actionable, and have been thoroughly vetted by a large research team. These companies, as you’ll learn, have almost no chance of ever going out of business, thus protecting your principal capital, but also having a chance of some serious growth.

This is exactly what we want to be focused on in our early investing days – protection, stability, income AND growth – which typically doesn’t come with income producing assets.

Whenever you’re ready, there are 3 ways I can help you level up your finances:

- Take an affordable self-learning e-course: COMING SOON

- Take our new interactive course The Indestructible Wealth Academy to help you buy ten cash flowing properties within two years, with the goal to create a million in equity: COMING SOON

- Ready to invest your money?

→ Buy cash flowing, turnkey real estate. It’s acquired, renovated, and managed for you by my company, High Return Real Estate.

→ Wish you had bought bitcoin back at $12,000? Now you can with my company Simple Crypto Mine. We provide the machines, the hosting, the technical expertise, and the maintenance. Watch bitcoin drop in your wallet every five days for another stream of passive income. Email me at [email protected] to request the investor packet.

→ Are you an Accredited Investor with larger amounts of capital to invest? Syndicated deals in self-storage and car washes are 100% passive and very lucrative. Email me at [email protected] to request the latest investor replay to learn more!